2022 Small Business Loan Rates Across Top Lenders

Finding a small business loan with a low-interest rate can be a real headache. Depending on the type of loan product, there can be substantial variation, with traditional bank loans having interest rates of under 3%, while some online lenders charge up to 100%.

It just doesn’t make sense, that is until you learn about the different types of loans and the factors that go into determining small business loan interest rates. As a general rule though, business loans have interest rates between 5% to 8%.

We’re going to share how business loan interest rates are calculated, what the interest rates are by loan product and lender, the factors that will determine the interest rate for your business loan, and how you can apply with LendThrive to finance your small business.

How Small Business Loan Interest Rates are Calculated

Convenient as it would be, there’s no way to know before approaching a lender what small business loan interest rate they can offer you. Within a particular loan product, interest rates can vary substantially because every small business is unique in its revenue, creditworthiness, assets, and history. A business that’s been around several years, has a consistent revenue stream of hundreds of thousands of dollars, that’s consistently made on-time payments with previous loans is a much safer bet than a startup that is still figuring out how to monetize its ideas.

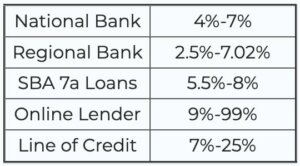

Small business loan rates do vary somewhat predictably though, largely depending on the types of businesses the lender is hoping to attract. Several different types of lenders are listed below with interest rate ranges that are likely to be encountered.

Small Business Loan Interest Rates

National Banks

National banks are less likely to approve loans for small businesses, especially those with a short history and limited revenue. It’s simply not worth their time to approve loans for businesses they don’t know much about when they could be lending to larger institutions. As such, they typically have higher interest rates that will deter small business owners.

Additionally, national banks loans often come with slower processing times, a higher level of paperwork, and a time-consuming application process. You may be asked to visit a local branch office and meet with a representative, which can take additional time out of your day that could otherwise be focused on growing your business.

Regional Banks

The majority of small businesses receive financing from regional banks. They’re more familiar with local business conditions and have a stronger relationship with their clients. Since small businesses are their bread and butter, they’re happy to offer lower interest rates to attract them.

Don’t let these lower interest rates fool you, though. Regional banks may also charge additional fees that are often higher than other lenders. The low interest rates may seem like a money-saver, but the fees may have you handing over a good portion of your savings.

SBA 7a Loans

These loans are backed by the federal government but administered by a traditional bank. If a business defaults on the loan, the government covers most of the cost for the bank. These loans can be up to $5,000,000 and have generous repayment periods. Their interest rates are based on a percentage set by the Federal Reserve called the prime rate, which is then combined with an interest rate negotiated between the borrower and the bank.

The downside to SBA 7a loans is that they have a lower approval rate and lengthy approval time. Many of them will also ask for collateral and more documentation than other lenders. Additionally, you’ll need to make sure you have a high credit score, as many won’t approve a loan without it.

Online Lenders

Compared to traditional banks, online lenders have substantially higher interest rates. They’re also more willing to lend to startups and businesses with poor credit. You can also be approved for a loan in less than a day, compared to the weeks or months it can take with a traditional bank or the SBA.

Line of Credit

This is essentially a credit card for your business, which is why it has an interest rate that could be as high as your personal credit card. However, you only pay interest on the money you spend, unlike business loans where you pay interest on the full lump sum. This gives small business owners an abundance of flexibility, especially when cash flows are highly variable.

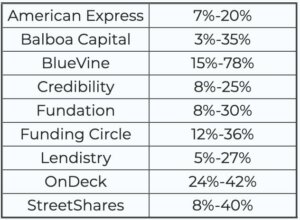

Business Loan Interest Rates by Lender

What Factors Affect Small Business Loan Rates?

Interest rates vary more between a lender’s clients than between the lenders themselves. This shouldn’t come as a surprise since those lenders are competing for business, but the clients coming to them have widely varying financial situations. These are some of the factors lenders consider when deciding small business loan rates.

Approval Time

Obtaining a low interest rate usually involves putting together large amounts of paperwork and submitting them to a bank, which might take weeks (sometimes months with an SBA 7a loan) to scrutinize before approving the loan. Many small business owners don’t have that kind of time; they need to make payroll or purchase vital equipment to keep their business running ASAP. In those cases, it may make sense to pay a higher interest rate to an online lender that can approve a loan in a day or so with minimal paperwork.

Credit Score

A business owner’s credit score is the very first thing any lender is going to look at. If it’s below 700, obtaining financing will be more difficult. A credit score shows how responsible you’ve been in paying back your credits. Missing payments or having bills sent to collections will severely affect your score.

Business owners with lower credit scores will have a high time getting approval for some of the more attractive financing options. They’ll also pay higher interest rates on the loans they do get approved for.

Repayment Terms

As a rule of thumb, loans with longer repayment periods have lower interest rates than ones with shorter repayment periods. It’s one reason why you can get a home loan with a thirty-year mortgage for close to 3% but a five-year auto loan can have an interest rate of 5% or more. Know that a lower interest rate paid over a longer period can result in you paying more in interest than if you’d received a higher rate with shorter repayment terms.

Business Financials

With more traditional loans from a national or regional bank, the lender will want to see things like balance sheets and profit-loss statements. They’ll go through this paperwork with a fine-toothed comb to learn exactly how well your business is performing. If your finances demonstrate that your business is sustainable or has potential for growth, you’re much more likely to be approved for a low interest rate loan.

Length of Time in Business

The amount of time that a business has been operating is a major factor for interest rates. Businesses that are around for a few years have weathered some storms and have likely paid back a few creditors already. They are a safer bet than businesses that are just getting started. Many banks will not give loans to small businesses that are less than a year old.

Choose LendThrive for a Low Interest Rate Small Business Loan

There are so many loan products to choose from and such a wide variety of lenders providing them, it can be challenging to find the one that’s right for your small business. However, if you’re looking for a fixed interest rate small business loan, LendThrive has you covered.

LendThrive provides small business loans of up to $150,000 in as little as 24 hours. LendThrive’s business loans also have flexible terms, allowing small businesses owners to choose a repayment period that works for them.

Apply today or contact us to learn how LendThrive can help your small business succeed.