How Small Businesses Can Leverage Invoice Financing

If you’re a small business owner, you know how hard it can be to find financing. Most banks will only consider businesses in operation for over a year, that have excellent credit, and aren’t saddled with debt. Meeting all those requirements is tough, especially when you’re cash-strapped and need working capital to pay employees or purchase vital equipment and supplies.

With accounts receivable financing, you don’t need to jump through all those hoops with a lender. Instead, you only need a set of invoices from customers that already reliably pay you. Keep reading to learn how invoice financing can get your business through difficult times without all the hassles that come with being approved for a loan.

What Is Accounts Receivable Financing?

Every month businesses send invoices to their customers requesting payment for goods and services rendered. These invoices may be paid immediately, or the customer may take a few weeks to make good on their payment. Customers that pay quickly free up capital that can be used to hire employees and purchase equipment, while customers that take their time paying keep that capital locked up. Accounts receivable financing or invoice financing unlocks that capital by allowing small business owners to sell the value of those invoices to a third party in exchange for an immediate cash infusion.

Accounts receivable financing can take a few different forms, but all rely on the same principle: outstanding invoices are sold to a lender at a discount, and the lender collects the payment for those invoices. Sometimes a business owner will sell all their outstanding invoices (non-selective), and sometimes they’ll sell only the invoices that will fetch the highest payoff from the lender (selective).

How Much Does Invoice Financing Cost?

As with any type of financing, the fees charged vary considerably depending on the nature of the agreement, the creditworthiness of the borrower, and any types of extra services offered by the lender. However, these are the typical fees you’ll encounter with accounts receivable financing.

Advance Rate

The amount the lender is willing to advance you will only be a portion of the invoice’s full value, typically around 80-90%. This gives them some leeway if some of the invoices go unpaid. Once all invoices are paid, the lender returns the remaining money minus the discount and service fees.

Discount Fee

This is where the invoice financing company generates its revenue. The discount fee is usually around 10% of an invoice’s value. The amount charged can go up with less creditworthy borrowers or down for those with a long-term arrangement with the lender. The discount fee also goes up the longer invoices go unpaid, with many lenders charging more after the first month of non-payment.

Other Fees

Most invoice financing companies also charge a service fee on top of the discount fee, but unlike the discount fee, it is unaffected by how long it takes for invoices to be paid. Some companies also charge a due diligence fee, a one-time fee for examining the creditworthiness of the borrower.

Borrowing Against Accounts Receivable

To better understand how accounts receivable financing works we’ll go through an example with a sample business.

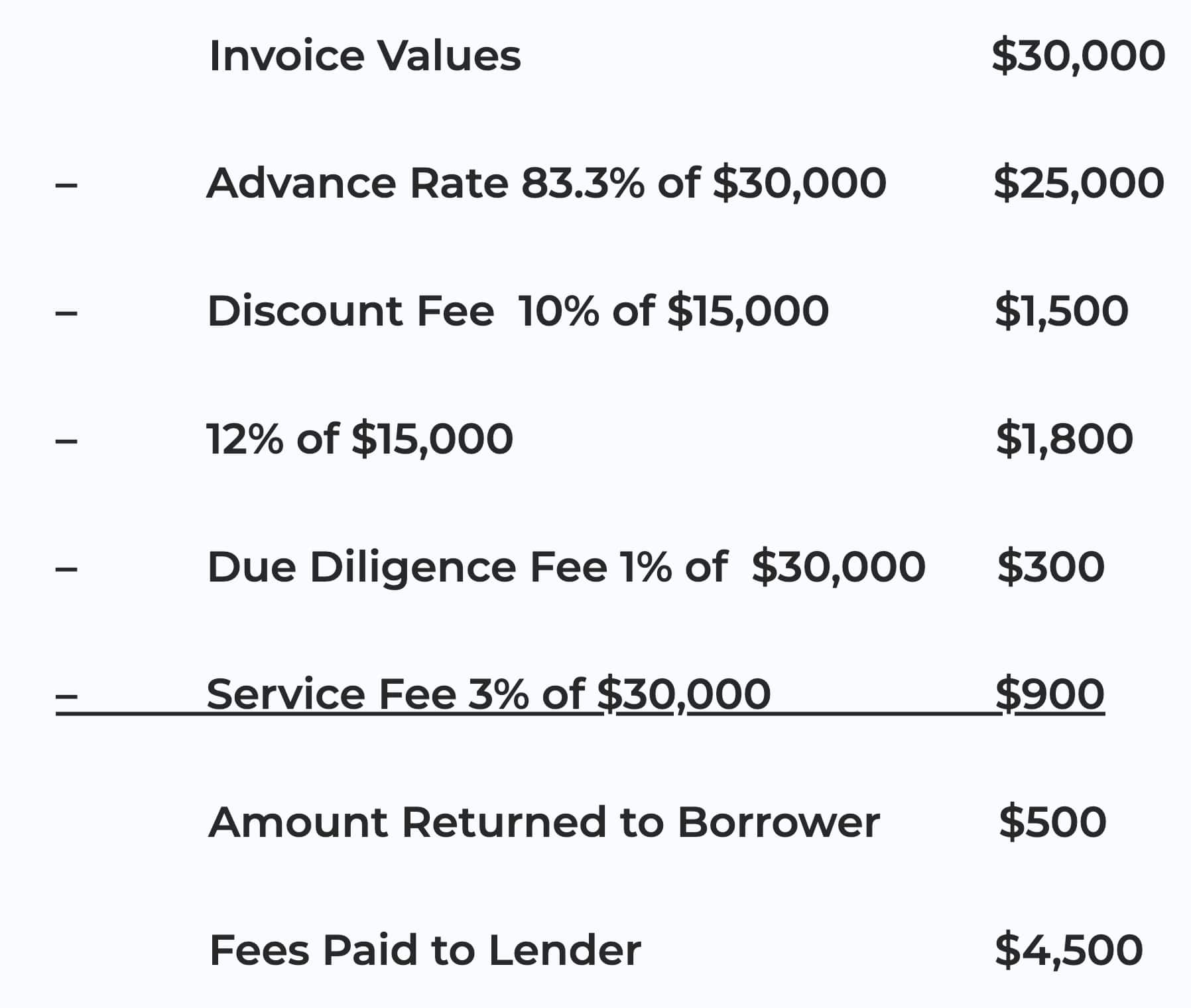

In this example, a paper company sells $30,000 worth of products to various office supply stores with an arrangement that invoices for the products are paid within 60 days. The paper company wants to purchase $25,000 worth of new equipment and decides to sell its invoices to a financing company to fund that purchase.

The lender advances the paper company $25,000, and the lender applies a discount fee of 10% for invoices paid within thirty days and a 12% fee for invoices paid within 60 days. They also charge a 1% due diligence fee and a 3% service fee.

Meanwhile, the lender waits to collect on the $30,000 it’s owed by the office supply stores. Half of the value of the invoices is paid within the first thirty days, and half is paid in the following thirty days.

After all of the invoices are paid, the lender returns $500 to the borrower, the amount left over after the discount and service fees. The total cost of borrowing $25,000 on the $30,000 loan was $4,500, or 15% of the invoices’ value.

Invoice Financing for Small Businesses

Invoice financing can be incredibly useful for small businesses that need cash immediately, but there are some downsides too.

Pros

Predictable Cash Flow

You know how much money your invoices bring in each month, so you can predict with some certainty the amount of money an invoice financing company will advance you, and discount fees are usually lowered for repeat borrowers.

No Debt

Lenders always look at how much debt a company has taken on. While invoice financing can provide your business with comparable amounts of cash to a loan, it does not appear as debt the way a loan would.

Not Affected by Credit Score

With invoice financing, the lender isn’t so much concerned about whether you can pay back the money as much as whether your customers can pay it back. If you have poor credit but your customers are always on time, invoice financing is one of the most effective methods for raising working capital.

Cons

Can Harm Customer Relationships

Invoice financing lenders count on your customers paying promptly which becomes a problem when they don’t. Lenders may contact your customers directly to let them know that you’re borrowing against their invoices and to request payment. This can rub customers the wrong way, especially if you’ve been lenient with payment schedules in the past. Those calls also make your customers privy to your cash flow issues.

Expensive

While it can provide a swift and reliable infusion of cash, it’s also a more expensive way to raise working capital. Most invoice financing lenders charge a discount fee of around 10% each year, and that does not include any extra service fees that can deduct another few percentage points from your invoice values. Traditional financing through a bank is considerably cheaper but often takes longer to get approval.

Alternatives To Invoice Financing

Invoice financing is but one option for businesses needing an immediate lump sum of cash. It’s also an expensive one, especially when compared to online lenders with fast approval times and low-interest rates. LendThrive provides businesses with loans of up to $150,000 and can approve applications in less than 24 hours. Interest rates are considerably lower than the discount rates usually encountered with invoice financing too. Apply now to see how a LendThrive loan can help your small business grow into the financial success you have always dreamt of.